Investing in land is not only about owning a piece of property but also about securing a lasting, tangible asset with a wealth of benefits. Unlike many other investments, land offers unique advantages that make it a compelling option for those looking to build a diversified and stable portfolio. Below are some of the key reasons why investing in land can be an excellent choice for your financial future.

Tangible Asset

One of the primary benefits of land investment is that it is a tangible asset with intrinsic value. Unlike stocks or bonds, which can fluctuate in value based on market trends and investor sentiment, land maintains a physical presence and intrinsic value. This means that, regardless of market volatility, land holds its worth and can provide long-term financial security.

Limited Supply

Land is a finite resource, and its availability is limited. As populations grow and urban areas expand, the demand for land increases. This growing demand, coupled with the finite supply, often leads to land value appreciation over time. Whether for residential, commercial, or industrial development, the limited availability of land makes it a scarce and valuable commodity.

Potential for Capital Appreciation

Historically, land values have shown significant appreciation, particularly in high-growth areas. Factors like population growth, economic expansion, and infrastructure development have the potential to drive up land prices. Investing in land in up-and-coming areas or those on the brink of development can offer substantial capital appreciation, making it a potentially lucrative long-term investment.

Diversification

Land offers excellent diversification benefits for an investment portfolio. By adding land to your portfolio, you can balance the risks associated with other assets like stocks, bonds, and real estate. Diversifying with land helps reduce portfolio volatility, ensuring that your overall investment strategy remains resilient in the face of market fluctuations.

Hedge Against Inflation

Land investment is often considered a reliable hedge against inflation. When inflation rises, so too does the value of land. As the cost of living increases, so does the demand for land, which tends to appreciate in value. Additionally, landowners can adapt to inflationary pressures by adjusting rental rates or developing the land for higher returns. This makes land a stable and dependable store of value.

Income Generation

Land has the potential to generate income in several ways, making it an attractive option for investors seeking regular cash flow. You can lease land for agricultural purposes, rent it out for commercial use, or even generate revenue through mineral rights royalties, hunting leases, or land development. These income-generating avenues provide steady financial returns, offering a balanced combination of both appreciation and cash flow.

Tax Benefits

Land ownership offers several tax benefits that can increase overall returns on investment. Investors may be eligible for tax deductions related to property taxes, mortgage interest, maintenance costs, and depreciation allowances. Moreover, if the land is sold for a profit, capital gains from land sales may be subject to favorable tax treatment, allowing investors to keep more of their earnings.

Portfolio Diversification

Land can play an essential role in enhancing the risk-adjusted returns of your investment portfolio. Due to its low correlation with other asset classes, such as stocks or bonds, land investments offer diversification benefits that help to stabilize the overall portfolio. During times of economic downturns or market volatility, land investments tend to remain relatively stable, making them a valuable asset in risk management strategies.

Asset Control

Another significant advantage of investing in land is the level of control it provides. As a landowner, you have the flexibility to decide how to use the land. You can lease it, develop it, or simply hold onto it for future appreciation. This control allows investors to align their land investment strategy with their financial goals, offering a degree of autonomy and decision-making power that many other investments lack.

Legacy Planning

Land investment offers unique opportunities for legacy planning and wealth transfer. Land can be passed down to future generations, providing lasting value for your family or heirs. Unlike other assets, land has the potential to appreciate over time, ensuring that your investment continues to grow and benefit future generations. By incorporating land into your estate planning, you can create a lasting legacy of financial stability and wealth for your loved ones.

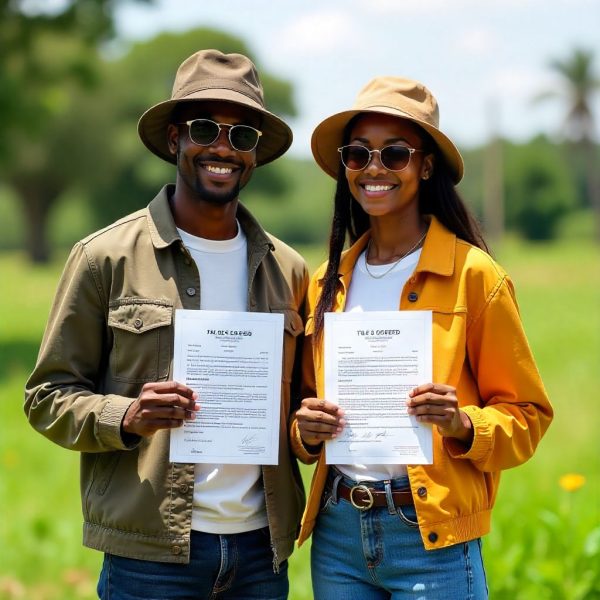

Conclusion: Secure Your Future with Think Real Estate

Investing in land offers a wide array of benefits, from tangible asset ownership to long-term capital appreciation and income generation. Whether you are looking to diversify your portfolio, hedge against inflation, or create a legacy for future generations, land investment provides opportunities that other asset classes cannot match.

At Think Real Estate, we are committed to helping you make informed investment decisions. Our expertise in the land market ensures that you find the best opportunities, whether you’re looking to buy land for personal use, commercial purposes, or investment. With our guidance, you can take advantage of the numerous benefits that land investment offers, while securing your financial future.

Contact us today to learn more about the available land options and how we can help you make the right investment choice. Let us help you grow your wealth with land investment.

📞 Contact Us: 0791 000 222 / 0792 000 222

📍 Visit Us: Kenol Town, Resource Plaza, 2nd Floor