Real estate remains one of the most reliable investment avenues in Kenya and globally. With urbanization, infrastructure development, and growing demand for affordable housing, real estate investment offers both security and long-term returns. At Think Real Estate, we help investors navigate this dynamic market, ensuring informed decisions that maximize value.

Whether you are a first-time investor or a seasoned buyer, understanding key insights about the market is crucial. Here’s what investors need to know:

1. Location Is Everything

The age-old saying, “location, location, location,” remains true in 2025. The value of real estate is heavily influenced by its proximity to:

-

Major towns and cities

-

Roads and highways

-

Schools, hospitals, and shopping centers

-

Employment hubs

For example, our Makutano Mwea project is strategically located near major roads and essential amenities, making it an ideal choice for investors seeking long-term appreciation and rental income opportunities.

SEO Tip: Include specific locations in content, e.g., “affordable plots in Makutano Mwea” or “real estate investment near Naivasha.”

2. Market Trends Shape Investment Decisions

Investors must stay aware of market trends to avoid losses and maximize gains. Some notable trends in 2025 include:

-

Rising demand for affordable plots: Many buyers prefer ready-to-build plots in growing towns.

-

Satellite town growth: Cities like Nairobi and Thika are expanding, pushing investors to surrounding areas.

-

Diaspora investment: Kenyans abroad are increasingly buying property, focusing on trust and transparency.

-

Technological integration: Virtual site tours, digital documentation, and online land registry systems simplify purchases.

3. Understand the Types of Real Estate Investments

Real estate is not one-size-fits-all. Investors should be aware of different options:

-

Land Banking: Buying undeveloped land in high-potential areas to hold until value appreciates.

-

Residential Properties: Houses or apartments for sale or rent, offering regular income.

-

Commercial Properties: Shops, offices, or warehouses for business purposes.

-

Mixed-Use Developments: Combining residential and commercial spaces for maximum ROI.

Why this matters: Each investment type has its risks, timelines, and profitability. For instance, Think Real Estate focuses on value-added, affordable plots, balancing low entry cost with high growth potential.

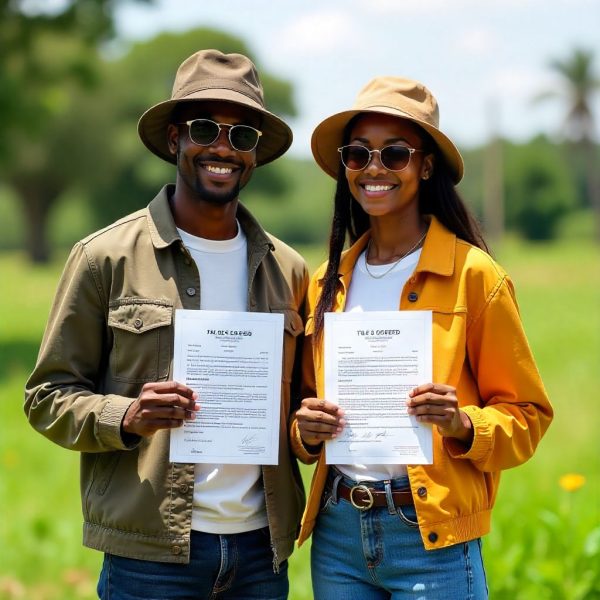

4. Legal Compliance and Title Deeds Are Non-Negotiable

One of the biggest risks in real estate is purchasing land without clear title deeds or proper documentation. Investors should:

-

Verify land ownership

-

Ensure the property is registered with the Land Registry

-

Confirm zoning regulations and land use

-

Avoid unverified brokers or sellers

At Think Real Estate, we provide genuine title deeds and fully verified plots, giving investors peace of mind and security for future transactions.

5. Timing and Patience Are Key

Real estate is a long-term investment. The most profitable opportunities often require patience. For example:

-

Buying in an emerging town may take 3–5 years for full appreciation.

-

Infrastructure projects like roads and utilities often trigger price increases over time.

Investors must also monitor economic conditions, interest rates, and government policies, as these influence market growth.

6. Financing and Payment Flexibility Matter

Affordable payment plans make property investment accessible to a wider audience. Many developers now offer:

-

Installment plans over 6–12 months

-

Low initial deposits

-

Financing options for diaspora investors

Think Real Estate offers flexible plans for investors who want to secure their plots without financial strain while ensuring transparency and legal compliance.

7. Potential ROI and Appreciation

The ultimate goal for any investor is return on investment (ROI). Factors that increase ROI include:

-

Strategic location

-

Nearby infrastructure developments

-

Social amenities

-

Security and gated community setups

For example, our Makutano Mwea plots are located in a rapidly developing area, ensuring strong long-term appreciation for early investors.

8. Sustainability and Community Planning Are Growing Priorities

Investors today are increasingly looking for:

-

Planned communities

-

Access to clean water and electricity

-

Environmentally-friendly development

Such factors not only improve the living experience but also boost property resale value over time.

Conclusion: Real Estate Investment Requires Knowledge and Strategy

Investing in real estate is more than buying property — it’s about making informed, strategic decisions. Understanding market trends, location value, legal compliance, and future growth potential is essential.

At Think Real Estate, we help investors navigate these decisions with affordable, value-added plots, verified documentation, and guidance for long-term wealth creation.

“Invest smart, invest early, and watch your land grow in value over time.”